How does the industry price currently?

Pricing is based on four factors

There are typically four factors that determine the delivery price:

- The distance the consignment must be moved

- The size of the consignment

- The time in which it must be delivered

- The market forces – What are competitors offering for the same service?

The first three factors attempt to consider the operational cost in transporting a consignment from point A to B.

The fourth factor considers some of the supply/demand factors for the market.

Could a parcel business change industry pricing practices?

Moving away from the current industry pricing mechanism, which factors in weight as a large proportion of the price, could grant protection against further declines in the average weight per consignment.

Given that the costs involved in moving freight are similar across broad weight classes, per item rates between destinations would better reflect the underlying costs involved.

Customers could still be given discounts for sending multiple items, which would reflect the benefit to the parcel business of doing less work for similar revenue.

However, a change of this nature would require re-educating customers on a large scale, and could leave the first mover vulnerable if other providers do not follow suit.

If leading the change in industry practice is too risky, are there other methods that can achieve similar results with less disruption to typical industry standards?

Revenue management offers a solution for parcel businesses

Revenue management is usually associated with the airline or hotel industries.

There are definite similarities between these industries and parcel businesses, which provide the opportunity to benefit from revenue management practices such as dynamic pricing:

- Large fixed asset base

- High fixed cost structure

- Short “product shelf life”

However, there are also distinct differences between the industries which prevent a simple replication of revenue management strategies:

- Bulk of the business is handled through supply agreements with business customers which are negotiated on an annual basis (especially when B2B is the dominant market for a service provider). There is no spot market for the product.

- The majority of parcel collections are booked on the day of pickup. Understanding demand cannot be done through evaluating the bookings already made, it must be done through trend analysis which tends to be very unreliable.

Even with these limitations, parcel businesses could consider adopting revenue management practices, in particular, dynamic pricing.

How does dynamic pricing typically work?

The benefit of consistent demand

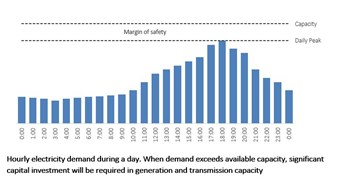

Other industries make use of pricing to influence (or at the very least, profit from) changes in demand over time. Industries such as telecommunications, electricity suppliers and internet service providers make use of dynamic pricing to try to manage hourly demand on their networks.

These companies do so in order cope with peaks in demand during the day. Their networks must be designed to cope with the maximum demand. If not, the network will suffer outages – dropped calls, brownouts or poor download speeds.

This management of demand improves the economic outcome for the business by:

- Avoiding the cost of expensive capital programmes to increase capacity

- Avoiding the cost of rectification where the agreed service levels are breached

- Avoiding the opportunity cost of missed revenue

- Improving the asset utilisation across the network by increasing activity on traditionally slower time periods.

When over capacity, service suffers

High volumes have a direct impact on customer service. As parcel businesses get busier, service quality declines. There is a direct correlation between volume of parcels in the network and the ability to deliver on time in full.

This has the immediate financial impact of customers making claims for deliveries not received on time and the longer term impact of losing customers or not being able to acquire customers due to poor service reliability.

It also has the less noticeable impact of brand erosion. Along with value for money, customers continuously rank the ability of a parcel business to deliver on time as a key differentiator when selecting a supplier.

Industry capital expenditure is already up

A parcel network should be sized to handle peak or near-peak volumes. If overall volumes continue to grow (growth being high on most CEO agendas), this will result in incremental capital spend and associated operating costs. Larger sortation facilities, additional linehaul trucking capacity, additional pickup and delivery (PUD) fleet and associated personnel to run it all.

This can already be observed in Australia. Toll opened a $170m facility to the north west of Sydney in July 2014 after spending $103m on facilities in Perth, Brisbane and Canberra. In February 2014, TNT announced a capital investment of $250m including new hubs in Sydney, Melbourne and Brisbane and a new facility in Perth is already operational.

The daily cycle in the parcel business

The daily cycle in a parcel business consists of two PUD runs, two sortation cycles and overnight linehaul trucking.

In the early morning, parcels are delivered by linehaul trucks to depots and the morning sortation window begins. Then PUD fleets head out to deliver the parcels, occasionally collecting a few parcels as well. After the midday break, the afternoon shift begins as the PUD fleet pick up all the parcels that are ready for collection and return to the depots for the afternoon sortation window. Parcels are loaded onto linehaul trucks and dispatched to their destinations to begin the cycle for the next day.

The problem in parcels is not peak hours, it’s peak days

There is already a form of dynamic pricing available. If you want a parcel delivered a little earlier, you can purchase a priority or express product. But the real problem is not managing the 8am to 9am rush, the real problem is dealing with the big surge of activity on a day. The large influx of parcels is what causes the network to choke.

Daily pressures are caused by:

- Customers delivering a trailer direct to the depot, causing a sudden spike in parcels to manage

- Weekly ebb and flow – Mondays have more deliveries and Fridays have more pickups.

We have observed that some depots do tend to have typically busy days, but for the most part operations have fairly predictable activity levels. This stems from the fact that a fixed number of PUD vehicles can only collect a certain number of parcels in a day.

A far bigger driver of “peak days” are direct trailer deliveries which create a sudden and often unpredictable surge in demand. The sudden surge extends the sortation window and can cause linehaul trucks to leave the depot later than expected. This puts pressure on the delivery cycle the following morning at the destination depots.

Flattening daily demand through pricing

An option for operators is to price in a way that encourages customers to:

- Shift the pick-ups of non-essential deliveries to non-peak days and

- Deliver trailers in a piecemeal or appropriately scheduled way

By re-distributing the extra consignments received from the direct trailer deliveries, the depot is able to manage the maximum activity level.

By managing the maximum activity levels at each depot, the operation is able to fulfil delivery promises without having to invest in additional capital or expensive additional variable capacity.

The price incentive to offer must be calculated to secure the benefit

The economic impact of the discount offered to incentivise customers to move trailer pickups to days that suit the operation must be more beneficial than the cost of extra capital or variable incremental capacity.

The discount must also be enough to incentivise the customer to consider improving their forecasting of outbound logistics.

The calculation requires a deep understanding of profitability across all dimensions and a good understanding of demand across all depots.

PCG’s analytical strength and depth of experience in the parcel business

PCG has invested heavily in its analytical capability, recruiting experienced senior analysts and forming a separate group, PCG Solutions, to tackle problems which require bespoke solution development.

PCG also has extensive experience in the parcel business and has implemented profitability models in Australia and the UK.

These models are used to evaluate and implement decisions such as the one in this article – helping management to make informed decisions that add to the profitability of the organisation.

Our profit improvement projects in the parcel business span the entire operation and our involvement in revenue management, procurement, operational efficiency and overhead reduction have achieved a return of more than ten times the consulting investment in the first year of implementation.